Travel Trends Impacting Pet Resort Businesses

Updated Monthly

The impact of the COVID-19 pandemic on the travel industry has been far-reaching and rapidly evolving. Additional economic and geopolitical issues are also influencing people’s travel decisions. And since pet resorts and the travel industry are inextricably linked, it’s important now more than ever to stay up-to-date on the latest trends.

In an effort to track and interpret current trends in the travel industry, free from political or media bias, we have compiled a collection of reliable data sources that provide an overview of travel patterns and transit methods. These sources include:

- Transportation Security Administration (TSA) Data for Air Travel

- Energy Information Agency (EIA) data for Gasoline Retail Supply

- U.S. Hotel Occupancy Rates

This information will be updated monthly for the foreseeable future. Links to recent news articles are also included below for additional insights into the travel landscape as it evolves.

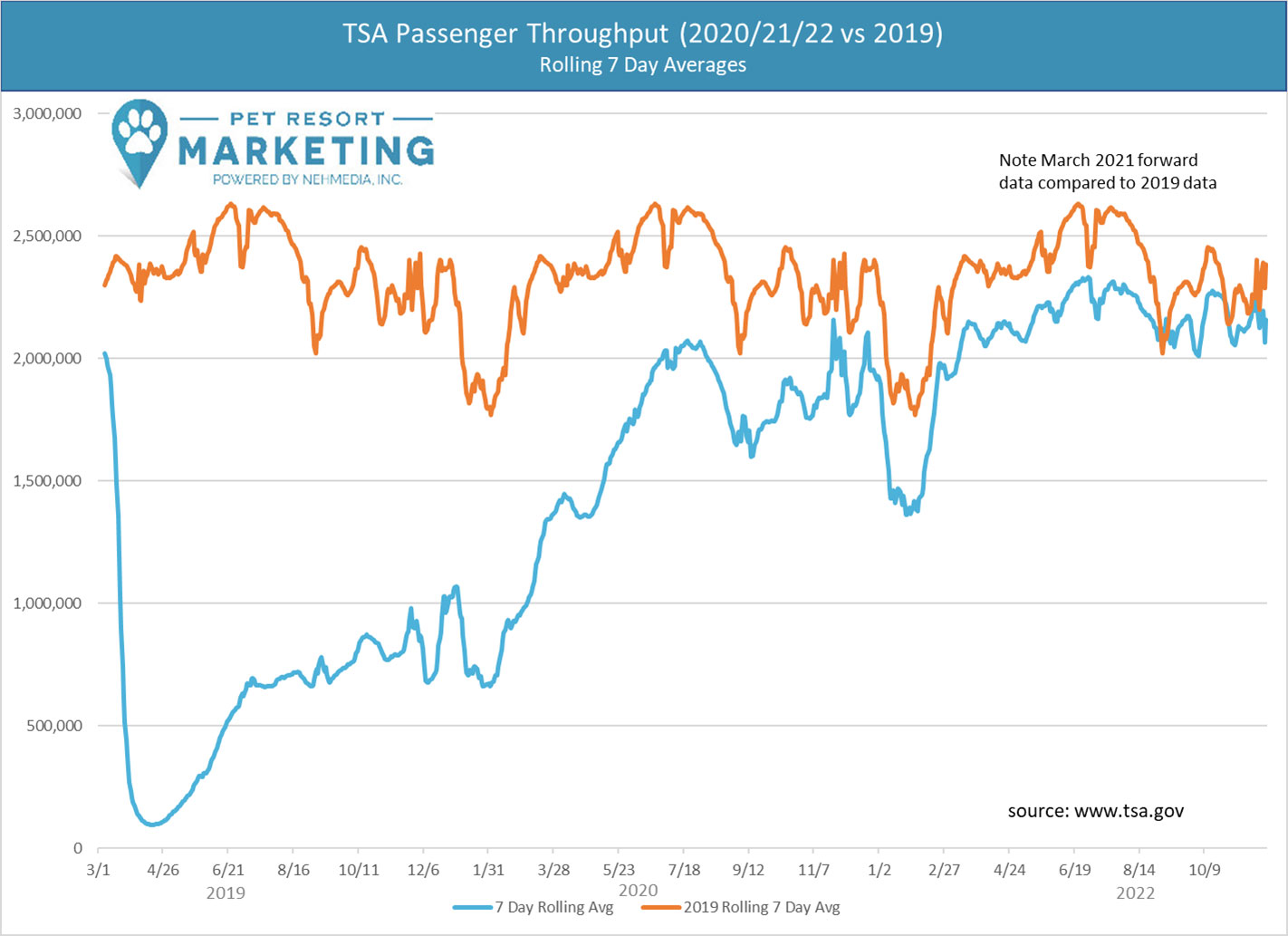

Transportation Security Administration (TSA) Data for Air Travel

As we enter December and recover from all the traveling, family and food at Thanksgiving, we realize Christmas is just around the corner. By all accounts, airline travel in the US went extremely well except for some weather delays, and many news outlets are reporting record travel levels. What is interesting is that the week before Thanksgiving, we ran only -2.4% behind 2019 TSA Passenger volume, but the week after Thanksgiving, Passenger volume dropped to -7.5% below 2019 levels. This is probably due to Thanksgiving being 4 days earlier in the month than in 2019. That is the reason there is a widening difference between 2019 and 2023 travel levels at the end of November going into December.If you average it out, we are still running about -4.6% behind 2019 for the last two weeks of November. This is about half the -9.2% average behind 2019 we have seen since the beginning of March 2022, except for the end of August when we exceeded 2019 levels. We suspect that high airline fares, a decreased number of routes, and pilot shortages all contribute to this trend, along with the lack of travel to and from China. Even with the threat of Covid, RSV, and the flu, travel has been pretty robust throughout 2022 but is still underperforming 2019 levels. What does this mean for 2023? We suspect due to inflation, pilot shortages and airline planning, some cities and routes will be running over 2019 levels, while others stay behind. For pet resorts, this means that travel will be occurring probably around the 2019 level in 2023 except for those markets that experience heavy Chinese tourism, and will run -3% to -4% behind overall 2019 daily volumes.

Updated through 12/1/2022

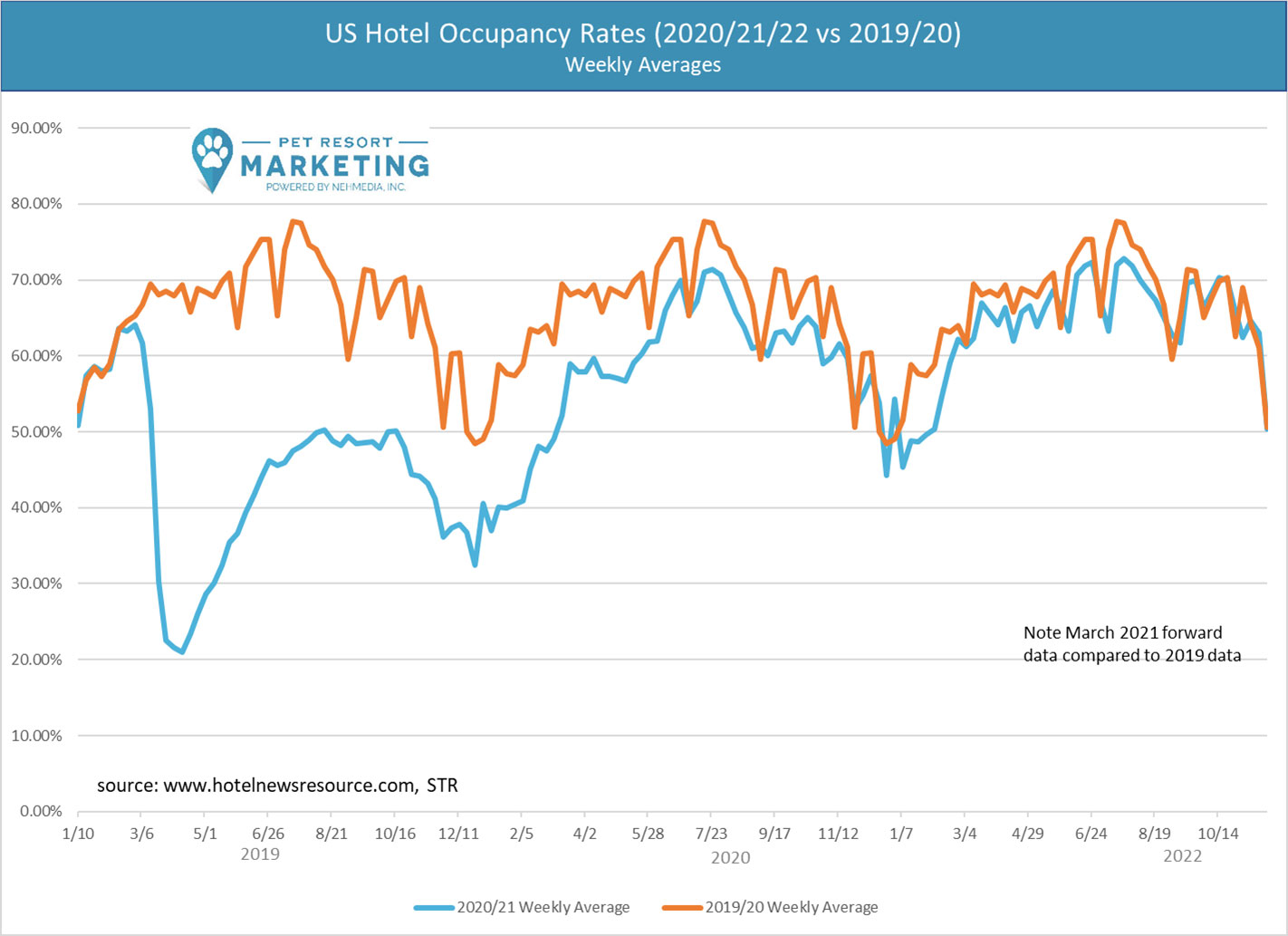

US Hotel Occupancy Rates

US Hotel Occupancy is starting to consistently mirror 2019 levels and in November actually was 1.56% above 2019 levels, probably due to the earlier Thanksgiving this year. As we approach Christmas, hotel occupancy will continue to drop until the end of the year – while people stay with family and business travel slows down – but will probably mirror 2019 levels very closely. We expect this trend to continue throughout 2023, with seasonal lows occurring in January and slowly rising to peak demand in the summer. This should indicate continued demand for boarding and daycare services from pet resorts similar to 2019.

Updated through 11/26/2022

Need help retaining or acquiring new customers?

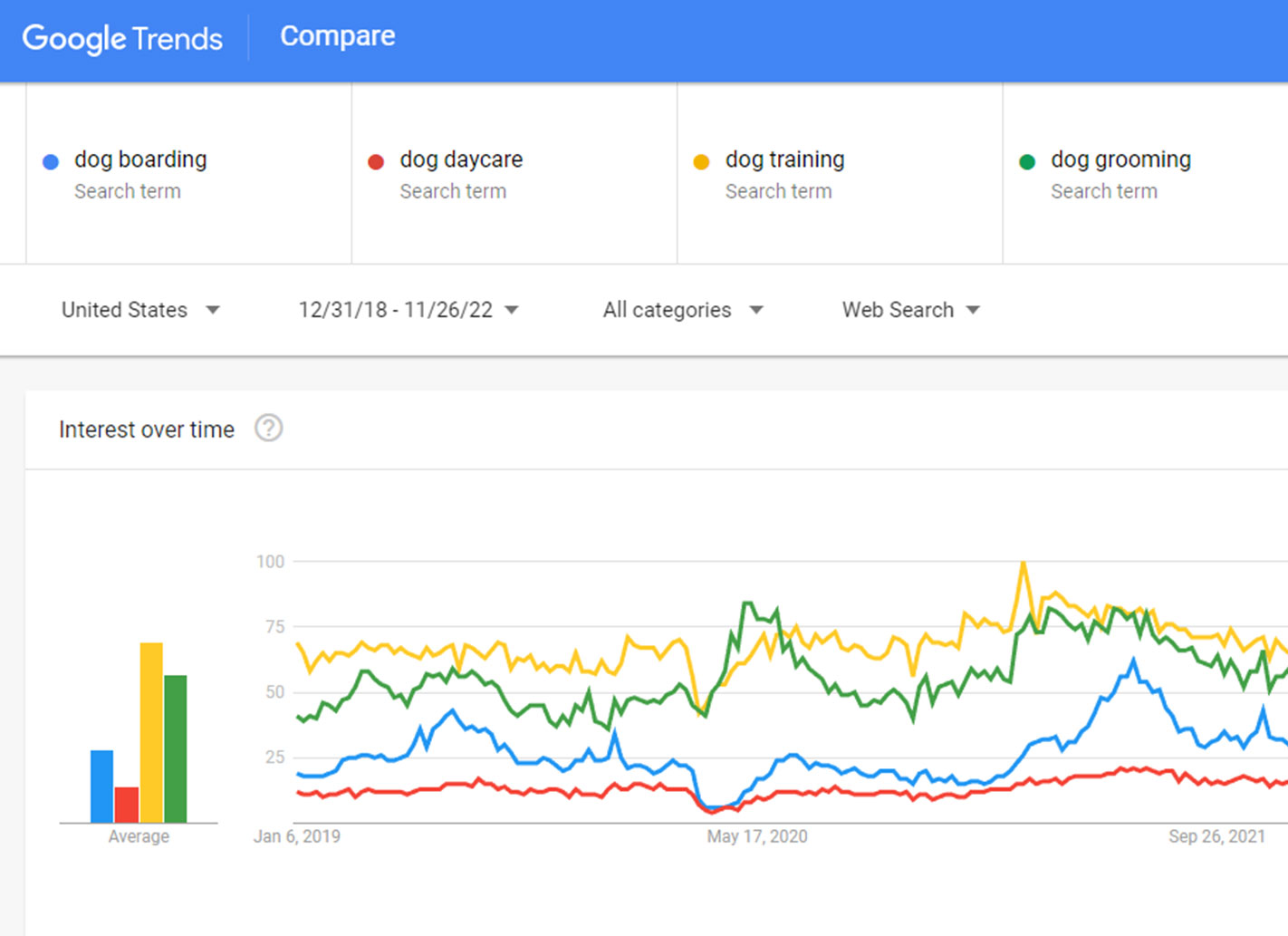

Pet Resort Google Search Trends

Our Google Trends review shows a troublesome decline in search interest relative to 2019 levels, falling significantly behind the strong search interest levels of 2021. All four areas of Dog Boarding, Dog Daycare, Dog Training and Dog Grooming both continue to track behind 2021 levels, and are closer to mirroring 2019 than 2021. So with the holidays approaching, don’t plan on the same level of demand you saw last year. In fact, there are a growing number of reports that animal shelters are seeing a rise in intakes and a decrease in adoptions in the later half of 2022. A lot of this trend is attributed to the rising cost of pet ownership and inflation. (https://www.insideedition.com/many-us-animal-shelters-filled-to-capacity-and-seeing-drop-in-donations-amid-inflation-78013). Some also attribute this to the “pandemic dog” being dumped, abandoned and abused. (https://www.wnem.com/2022/11/04/shelters-face-capacity-crisis-pandemic-pets-get-abandoned/). We will explore each of the service areas and see their specific trends.

Updated through 11/26/22

Year Over Year Pet Resort Search Trends

Click the images to enlarge.

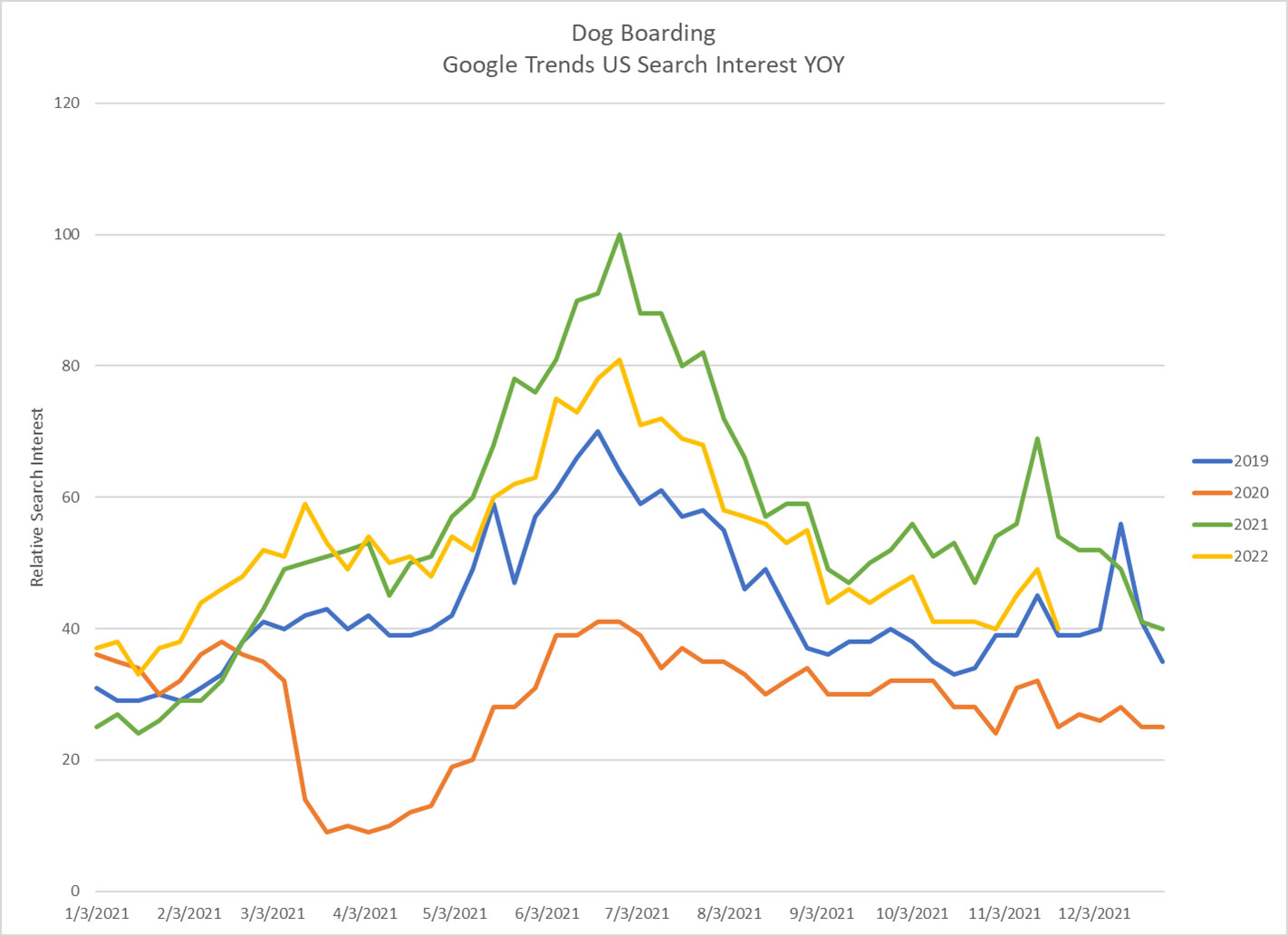

Dog Boarding 2019 vs 2020 vs 2021 vs 2022

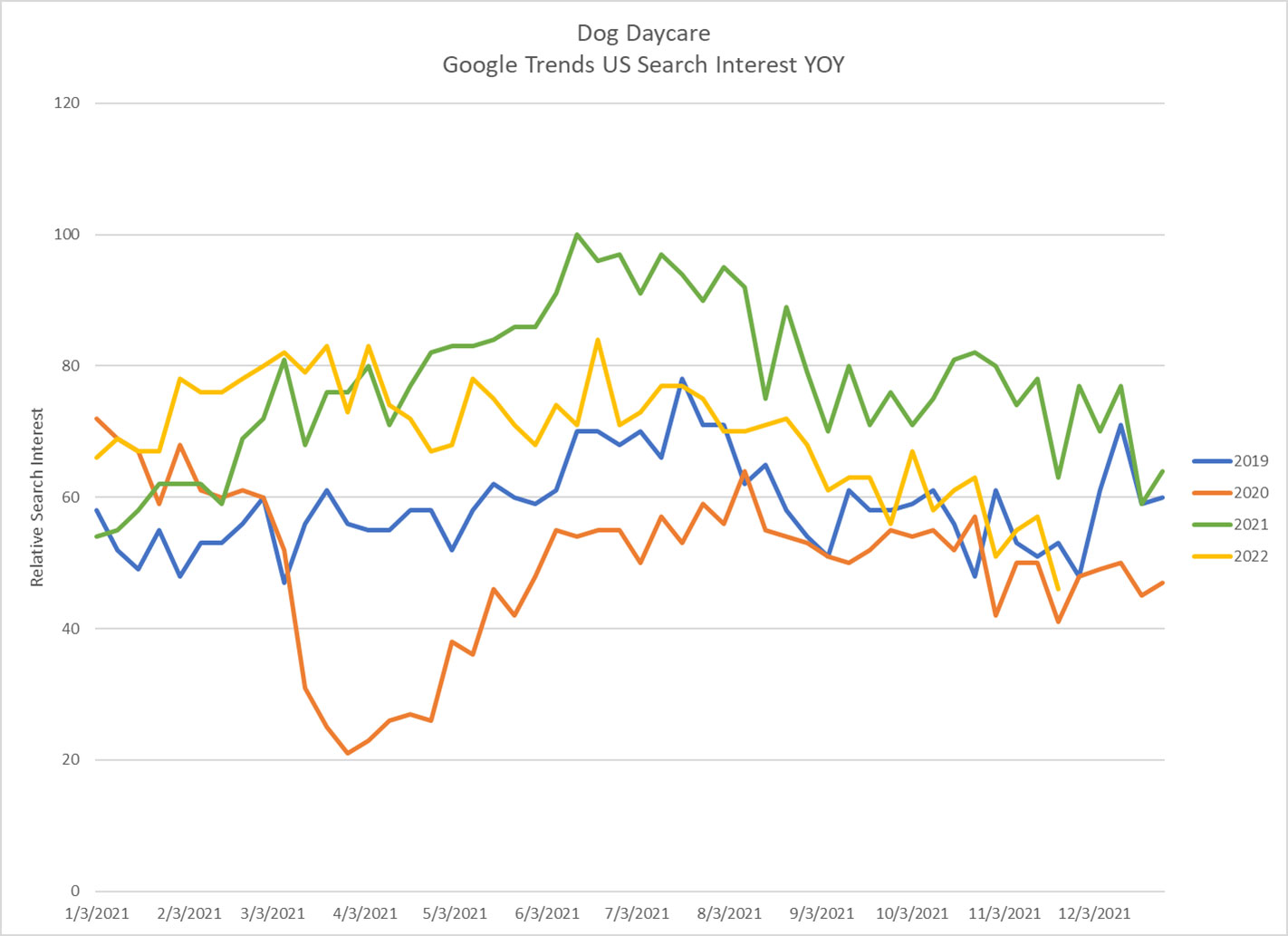

Dog Daycare 2019 vs 2020 vs 2021 vs 2022

The search interest in Dog Boarding continues to decline with a significantly smaller surge in search interest related to Thanksgiving this year. Search Interest is right back at 2019 levels around Thanksgiving. For the last four weeks, search interest ran -25.1% behind 2021 levels and 7.4% above 2019 levels. We do expect a surge as we approach Christmas, but given that the end of 2021 saw another Covid outbreak, we think boarding demand will be more similar to 2019 levels. Then as we go into January, we will see the seasonal drop in demand starting to grow until March and the Spring Break travel periods.

Dog Daycare has been running closer to 2019 levels since September of this year and has run -22.8% behind 2021 levels and only 3.9% above 2019 levels. The gap actually widened in October, showing right on top of 2019 levels. Over the week of Thanksgiving, demand dropped -13.2% below 2019 levels. This most likely is due to rising inflation and people cutting back on their spending. Non-essentials like Dog Daycare will be one of the areas that will suffer from high inflation pressures driving down demand. We expect demand will pick up in this month as people prepare their homes for the holidays and get their dogs out of the house during the day, especially as winter starts to set in. We expect to be slightly above 2019 levels for dog daycare demand the rest of the year going into January. The big challenge is that we don’t expect spring will match demand levels from 2021 and 2022, or even early 2020. Plan for 2023 spring to be about 20% below the past few years

Updated through 11/26/22

Updated through 11/26/22

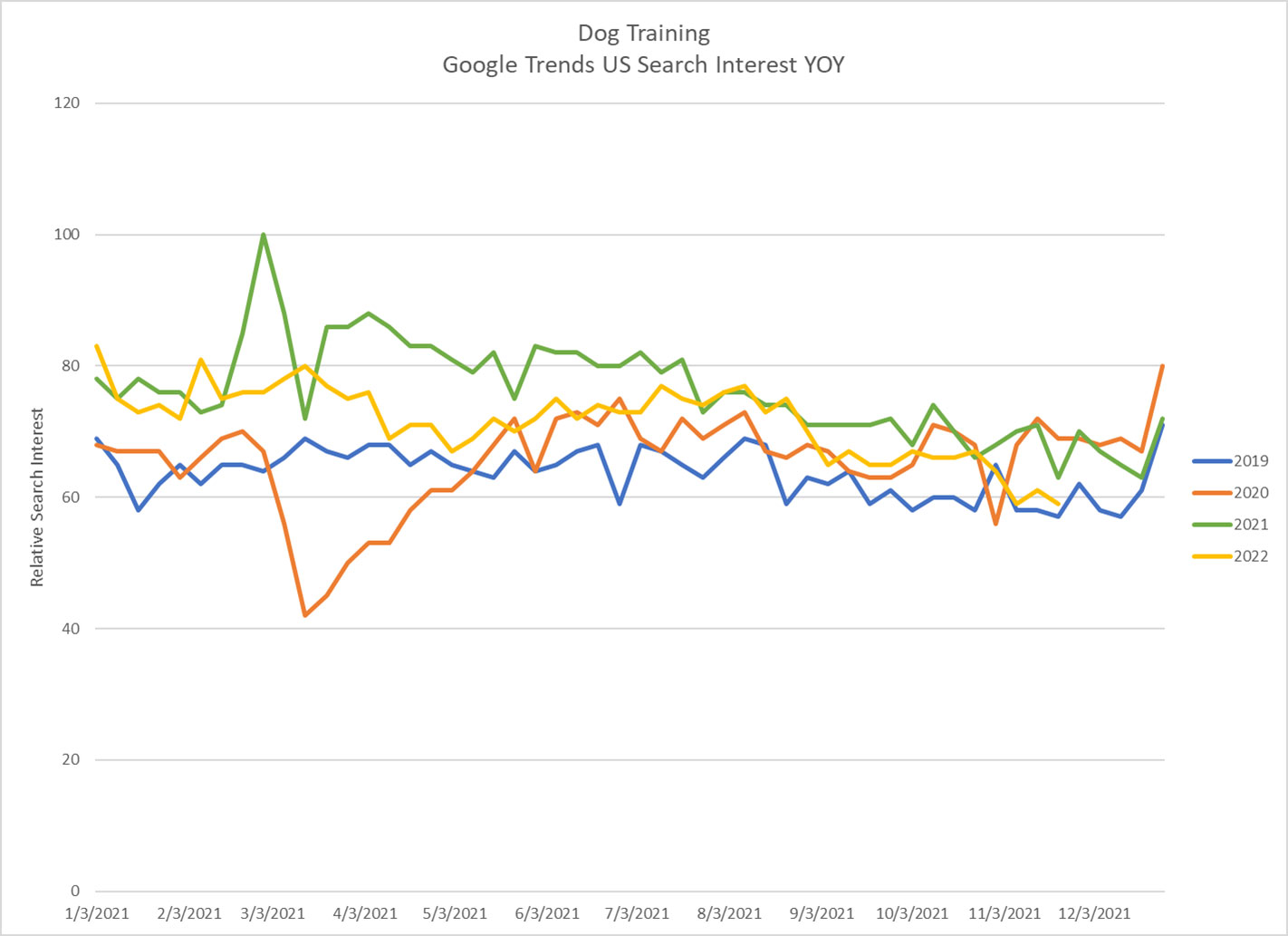

Dog Training 2019 vs 2020 vs 2021 vs 2022

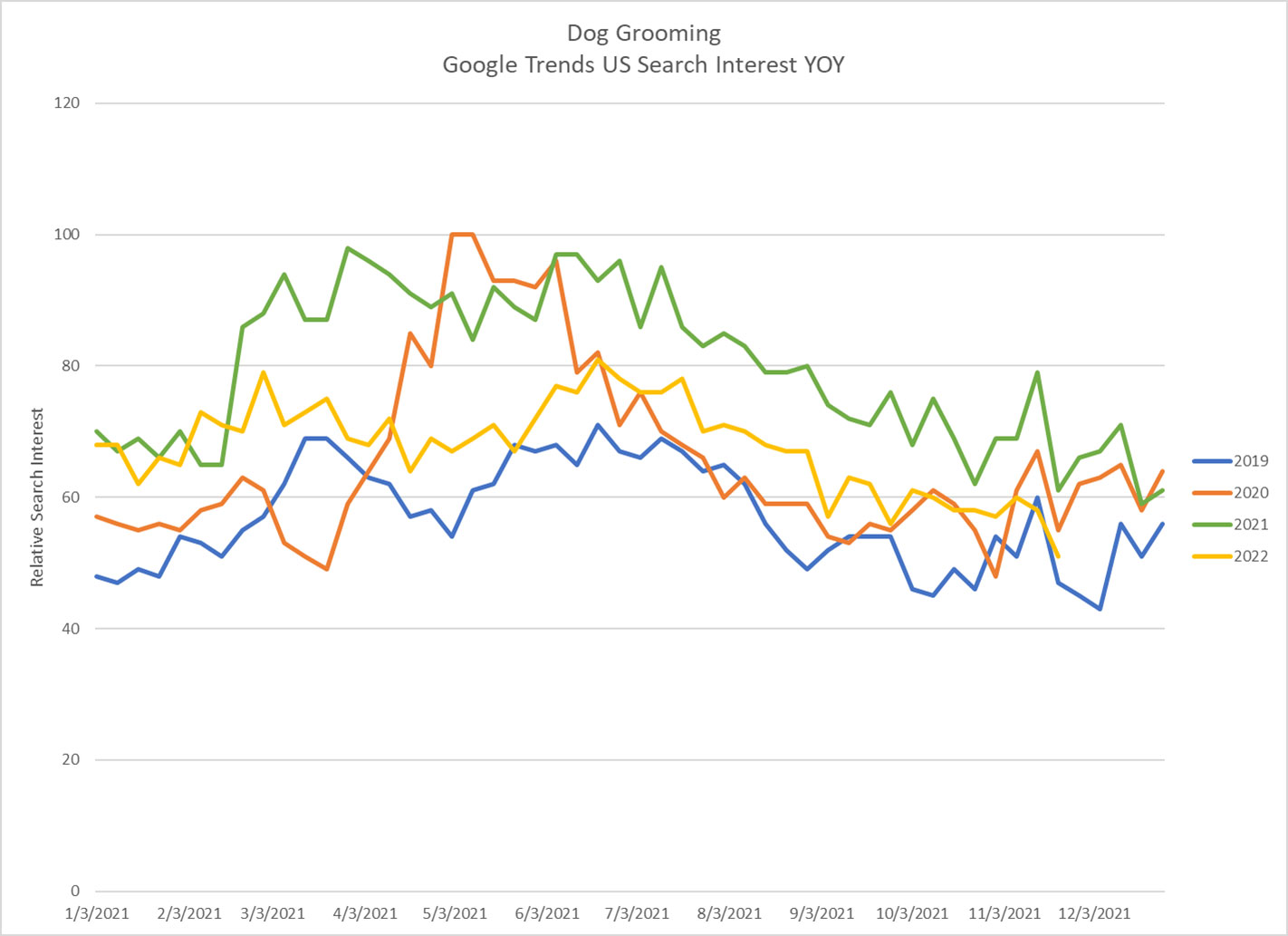

Dog Grooming 2019 vs 2020 vs 2021 vs 2022

Dog Training demand has had less of an overall variation in search interest comparing the past 4 years. But like Dog Boarding and Daycare, demand is again mirroring 2019 levels toward the end of November. We expect the usual surge in training demand as new puppies are brought home as Christmas presents, but demand will probably be below 2019 levels. For November, search interest was -10.5% below 2021 levels, and 2.2% above 2019 levels. So expect December to probably be between 0%-2% of 2019 levels, while staying around 2019 levels in the spring of 2023.

Dog Grooming continues the story that we have seen in the other three pet care areas. Grooming ran -18.4% behind 2021 levels, and 7.1% above 2019 levels for November. Also grooming dropped to -3.3% behind 2019 levels the week before Thanksgiving, but it didn’t drop as much the week of Thanksgiving. We expect to see a weak demand the first few weeks of December which is a seasonal trend, and then picking up right before Christmas. For January, depending on the weather, we expect demand to be between 2019 and 2020 levels, but definitely not at 2021 and 2022 levels due to inflation and the growing shelter capacity.

Updated through 11/26/22

Updated through 11/26/22

In Summary

All these trends indicate that planning for 2023 requires a realistic perspective that the new year will not look like 2021 and 2022. This means investing in marketing and promotion to ensure you get your fair share of business becomes critical for your success in 2022. If your pet resort business is having challenges retaining or acquiring new customers for services like dog boarding, dog daycare, pet grooming and dog training, please reach out to us so we can make sure pet owners can find your business online. With the trends we see, competition will be stronger in 2023 as there will be more competition for fewer pets than we saw in 2021 and 2022. While we know that many pet resorts have fared surprisingly well post-pandemic, except for the staffing challenges, 2023 is going to be much different. We recommend continuing to invest in branding and engagement campaigns to maintain brand visibility to capture as many customers as possible by attracting new customers and supporting your existing clientele.